India’s business landscape is evolving rapidly. Organizations are under pressure to digitize operations, strengthen vendor ecosystems, and maintain efficiency — all while navigating an increasingly complex compliance environment. For finance and procurement leaders, the procure-to-pay (P2P) process sits at the center of this challenge.

The P2P cycle — from requisitioning to vendor payments — is not just about operational efficiency. It’s also a compliance-critical function, subject to oversight from regulatory authorities including the Ministry of Corporate Affairs (MCA), Reserve Bank of India (RBI), and Goods and Services Tax (GST) authorities. Businesses must therefore strike a delicate balance between automation and stringent regulatory control.

This guide explores the compliance challenges of P2P in India, the role of automation in bridging those gaps, and how companies across industries can build stronger governance frameworks.

The Compliance Landscape in India

Indian businesses operate under one of the most layered compliance ecosystems globally. The following regulations shape the way procurement and payments are managed:

- Companies Act, 2013 – Mandates statutory audits, board approvals for related-party transactions, and financial transparency.

- GST Regulations – Require accurate documentation of taxable supplies, input tax credit eligibility, and reconciliation of vendor invoices.

- RBI Guidelines – Govern cross-border payments, forex transactions, and financial prudence.

- Indian Accounting Standards (Ind-AS) – Demand accurate recognition and reporting of procurement liabilities.

- Anti-Corruption and Ethics Laws – Such as the Prevention of Corruption Act, influencing vendor selection and approval workflows.

For businesses, the challenge is not just complying with one regulation but ensuring integrated compliance across the entire P2P cycle.

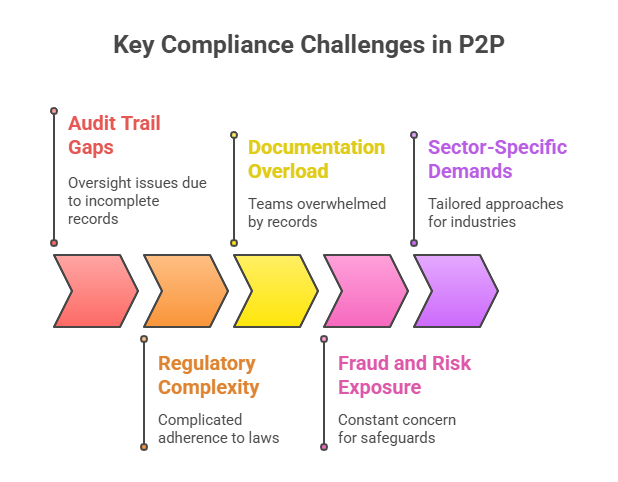

Key Compliance Challenges in P2P

Indian enterprises face several roadblocks when relying on manual, fragmented systems:

- Audit Trail Gaps

- Disconnected processes make it hard to maintain a unified record of requisitions, approvals, invoices, and payments.

- Missing documentation complicates statutory and internal audits.

- Regulatory Complexity

- Different rules apply to different procurement activities (e.g., capex purchases, service contracts, imports).

- GST reconciliation and vendor compliance checks are error-prone without automation.

- Documentation Overload

- Physical or semi-manual systems struggle with storing, retrieving, and presenting documents for audits.

- Related-party transactions and transfer pricing compliance require meticulous evidence that many companies lack.

- Fraud and Risk Exposure

- Manual approval chains create room for duplicate invoices, fraudulent vendors, or unauthorized payments.

- Sector-Specific Demands

- Pharma requires regulatory alignment with both Indian and FDA standards.

- IT services face stringent client-driven audit requirements.

- Manufacturing companies must show proof of environmental, health, and safety compliance linked to procurement.

These challenges not only increase compliance risk but also slow down financial close cycles and erode supplier trust.

How Automated P2P Systems Strengthen Compliance and Control

Automation has emerged as the strongest response to India’s complex compliance ecosystem. Here’s how modern P2P platforms transform compliance management:

- Comprehensive Audit Trails

- Every requisition, approval, vendor interaction, and payment is logged digitally.

- Regulators and auditors can trace a clear sequence of actions, ensuring transparency.

- Automated Compliance Checks

- GST validations (HSN/SAC codes, tax rate application, and credit eligibility) are automated.

- Approval workflows are aligned with company policy and statutory thresholds under the Companies Act.

- Fraud Detection and Prevention

- AI models identify duplicate invoices, unusual payment requests, and high-risk vendors.

- Real-time alerts reduce the chance of compliance breaches.

- Real-Time Monitoring

- Dashboards provide compliance officers and CFOs with live visibility of procurement activity.

- Deviations from policy are flagged instantly for corrective action.

- Secure Documentation and Data Integrity

- Vendor contracts, invoices, and approval records are stored digitally with tamper-proof integrity.

- Strong data controls ensure records withstand both internal and external audits.

Specific Compliance Requirements Supported by Automated P2P

- GST Compliance

- Automated invoice matching with purchase orders and GST filings.

- Accurate tax credit claims and reduced risk of GST mismatches.

- Statutory Audit under the Companies Act

- End-to-end visibility of financial records linked to procurement.

- Board-level approval workflows for related-party and high-value transactions.

- Internal Audit Standards

- Continuous monitoring of controls and real-time evidence collection.

- Digital audit trails that align with ICAI (Institute of Chartered Accountants of India) expectations.

- Transfer Pricing & Related-Party Transactions

- Automated documentation of intercompany procurement and pricing.

- Evidence-based reporting for compliance with income tax and MCA guidelines.

- Anti-Corruption Measures

- Transparent supplier selection with digital evidence of evaluation criteria.

- Automated checks to prevent conflicts of interest and policy violations.

Industry-Specific Compliance Considerations

- Public Sector Undertakings (PSUs): Require strict adherence to CVC (Central Vigilance Commission) guidelines and e-procurement norms.

- Pharmaceuticals: Must integrate FDA and CDSCO (Central Drugs Standard Control Organization) compliance with procurement of raw materials and equipment.

- IT Services: Subject to rigorous client audits and data security checks, necessitating detailed vendor records.

- Manufacturing: Need compliance with environmental, health, and safety regulations tied to raw material procurement and waste management.

Implementation Strategies for Indian Businesses

- Map Regulatory Requirements to P2P Workflows

- Identify compliance touchpoints in requisition, approval, invoicing, and payment.

- Digitize Documentation

- Move away from paper-heavy processes; ensure all documents are centrally accessible.

- Embed Policy in Automation

- Configure approval workflows to mirror statutory and company-specific rules.

- Leverage AI for Risk Monitoring

- Use predictive analytics for vendor risk scoring and fraud detection.

- Train Teams on Compliance-First Mindset

- Technology is powerful, but people must understand their accountability in maintaining compliance.

In India’s evolving regulatory ecosystem, P2P compliance and control are no longer back-office functions — they are strategic pillars of governance and growth.

By adopting automated and AI-driven P2P systems, Indian businesses can:

- Minimize regulatory risks.

- Maintain complete, transparent audit trails.

- Strengthen supplier and stakeholder trust.

- Achieve operational transparency that drives competitive advantage.

Robust P2P compliance is not just about staying on the right side of the law. It’s about building a foundation for sustainable growth, governance excellence, and digital transformation leadership in the Indian market.