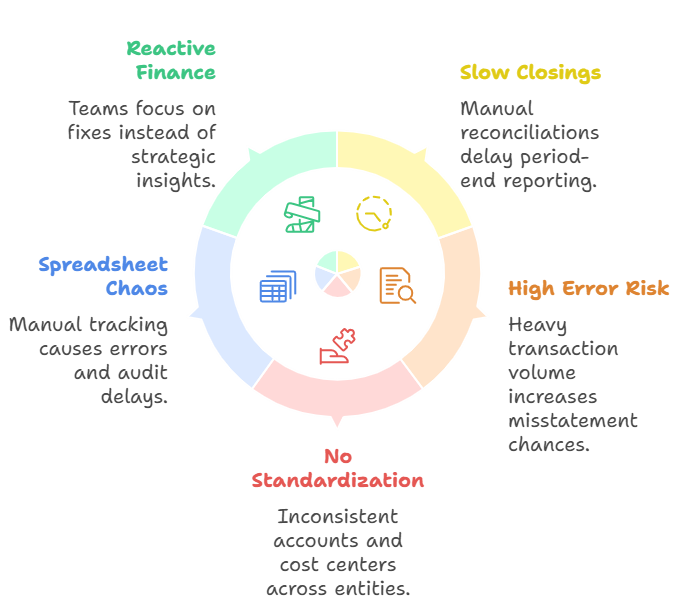

The Record to Report Challenge

Our Solution – Automated Record to Report Workflows

Core R2R Capabilities

Planning & Management Accounting

General Accounting & Reporting

Fixed Asset & Payroll Accounting

Vendor & Material Master Data Governance

Automation Capabilities / Technical Blueprint

Reconciliation Engine

Auto-matching for bank, sub-ledger, and intercompany accounts.

Journal Automation

Templates and rule-based journals for standard entries.

ERP Integration

Real-time sync with SAP, Oracle, Odoo, Tally, NetSuite, and others.

Compliance Rule Checks

Alignment with tax, GAAP, IFRS, or local statutory frameworks.

Exception Handling Workflow

Non-matching or flagged entries routed for manual approval.

Audit Logging

Detailed history of entries and reconciliations for regulator and auditor access.

Why Choose Us

FAQs

×

Before You Leave...

Learn how Record-to-Report (R2R) and General Accounting Automation can strengthen accuracy, improve compliance, and speed month-end close.

Schedule a Free Consultation