My phone rang at 8 PM last Tuesday. Priya, a CFO I’ve worked with for years, sounded frantic. “We just discovered we’ve been double-paying a few vendors,” she said. “The board meeting is tomorrow morning.”

This wasn’t her first obstruction with AP problems, but duplicate payments? That caught everyone off guard. By the time we finished our call, we’d identified ₹1.2 crores in potential recoveries. Not exactly the news you want to deliver to your board.

Here’s what bothers me most about these situations – they’re completely avoidable. Yet I get calls like Priya’s every week.

Why Smart Companies Keep Making Dumb Mistakes

Let me tell you about Rajesh, an AP manager at a textile company in Chennai. A great guy, super organized, runs a tight ship. But his biggest headache? Three different departments are sending him the same invoices.

Purchase sends scanned copies. Accounts receive email PDFs. The warehouse forwards delivery receipts with attached invoices. Same vendor, same amount, same everything – except nobody talks to each other.

Rajesh showed me their vendor master last month. Absolute chaos. One vendor appeared 47 different ways in their system — sometimes as a Pvt. Ltd., sometimes as a Ltd., occasionally with a city or country in parentheses. You name it, they had it listed.

Rajesh showed me their vendor master last month. Absolute chaos. “Bharat Electronics Limited” appears multiple different ways in their system. BHARAT ELECTRONICS LTD. Bharat Electronics Pvt. Ltd. Bharat Electronics (India). You name it, they’ve got it listed.

Each entry looks different to the computer. To the payment system, these are 47 separate vendors who can all submit invoices independently. Recipe for disaster? Absolutely.

The real killer happens during closing periods. I’ve watched AP teams process invoices at lightning speed, skipping every validation step they normally follow. Month-end pressure makes people do crazy things.

What Nobody Tells You About the Real Cost

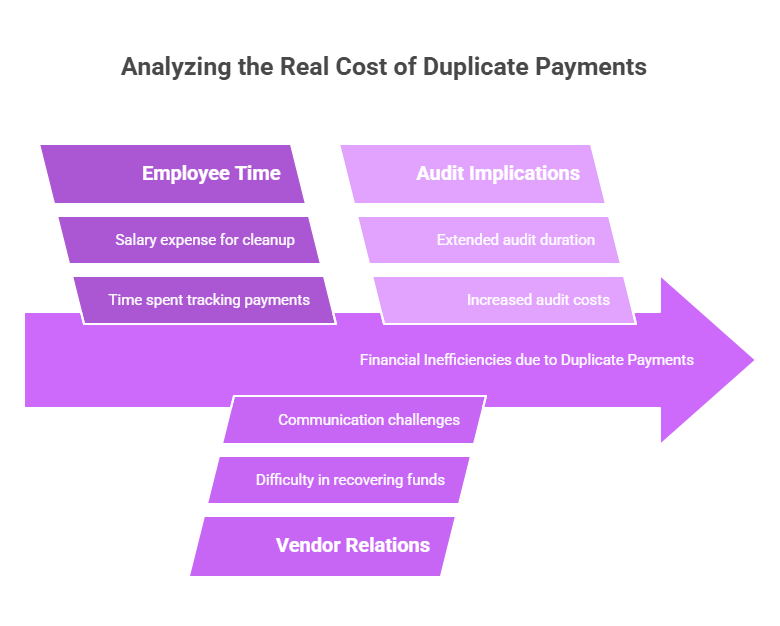

Forget the obvious cash flow hit for a minute. Think about poor Sunita in accounts payable spending her entire Friday tracking down a ₹8 lakh duplicate payment from three months ago. That’s eight hours of salary expense for cleanup work that shouldn’t exist.

Then there’s the vendor dance. Ever tried getting money back from a supplier who’s already deposited your check? I have. It involves approximately seventeen phone calls, six emails, and at least two promises to “look into it.” Some vendors act like you’re asking for their firstborn child.

Auditors love finding duplicate payments. To them, it signals weak controls throughout your entire financial operation. They start digging deeper, asking more questions, and extending their stay. What began as a routine audit becomes an expensive fishing expedition.

Simple Fixes That Actually Work

Three-way matching isn’t optional anymore – it’s survival. Purchase order, invoice, goods receipt. All three must align before any payment goes out. Period. No exceptions for “urgent” requests or “trusted” vendors.

I helped one manufacturing company implement this rule last year. Their CFO fought me initially, worried about slowing down payments. Within three months, they’d prevented ₹40 lakhs in duplicate payments. He stopped complaining.

Clean up your vendor database like your life depends on it. Merge duplicates ruthlessly. Create naming standards and stick to them religiously. Train whoever manages vendor setup to recognize variations before creating new records.

Most importantly, split duties across different people. Invoice receipt, validation, approval, payment processing – different person for each step. When multiple eyes see every transaction, mistakes become much harder to hide.

Tech That Actually Helps (Without Breaking the Bank)

Modern Account Payable platforms use smart matching algorithms that catch duplicates humans miss completely. They compare more than just invoice numbers – vendor patterns, amount similarities, even document layouts get analyzed.

Your current ERP probably has unused duplicate detection features gathering dust. Most systems can flag identical amounts from the same vendor within specified timeframes. Takes five minutes to set up, saves thousands in preventing errors.

Vendor portals work beautifully when implemented correctly. Suppliers upload invoices directly, get instant status updates, and can’t accidentally submit duplicates through the built-in validation. Plus, you eliminate those constant “where’s my payment?” calls.

Stop Waiting for the Next Disaster

Pull last quarter’s payment reports right now. Sort by vendor name and amount. Look for patterns that make you uncomfortable. I guarantee you’ll find something worth investigating.

Every duplicate payment represents money that could be earning returns elsewhere. The time your team spends chasing these errors could be focused on strategic initiatives that actually grow the business.

ValueDX: Solution To End Duplicate Payments

We designed Account Payable Automation at ValueDX specifically for situations like Priya’s and Rajesh’s. Our platform combines intelligent duplicate detection with seamless workflow integration, catching problematic invoices before they reach approval stages.

Results speak louder than promises. Our clients typically see 90-95% reduction in duplicate payments within 60 days. One automotive parts distributor recovered lakhs in their first quarter while cutting invoice processing time by 90%.

The system learns from your payment patterns, getting smarter with each transaction. Integration with existing ERPs happens smoothly, without disrupting current operations. Your team gets cleaner data, vendors receive faster payments, and you sleep better knowing duplicates are virtually eliminated.

Ready to discover your hidden duplicate payment exposure? ValueDX provides comprehensive risk assessments that analyze payment patterns and highlight potential problem areas. Schedule yours today – most companies are genuinely surprised by what we uncover in their data.

Send your sample invoice to info@valuedx.com — we’ll get back to you with the extracted data.

Read our next blog – Click here

Author: Pramod Ishwarkatti