Last Tuesday, I was on a video call with Priya, a controller from a textile conglomerate. She was calling from her car, stuck in Pune traffic after another 12-hour day. “You know what’s killing me?” she said, rubbing her temples. “Yesterday I spent four hours figuring out why our Coimbatore unit’s invoice numbers weren’t matching Mumbai head office reports.”

That conversation hit me because I’ve been there. I’ve sat through boardroom discussions where brilliant CFOs apologize for delayed month-end closures, not due to incompetence, but because they’re wrestling with systems never designed for multi-location reality.

When AP Becomes Your Biggest Operational Headache

Multi-entity accounts payable is broken for most Indian businesses. Companies running manufacturing in Tamil Nadu, offices in Maharashtra, and sales teams across six states try funneling financial data through systems treating each location like an isolated island.

A pharmaceutical finance head recently told me: “We have brilliant people, cutting-edge manufacturing, international clients – but our invoice approval runs slower than a 1990s government office.”

Here’s what actually happens. Bangalore uploads invoices to one system, Delhi uses email approvals, and international subsidiaries operate different software. Meanwhile, you’re in Mumbai trying to create consolidated cash flow reports, manually downloading data from five platforms.

I worked with a logistics company where their Accounts Payable manager maintained Excel sheets for each state’s GST calculations. Different rates, compliance requirements, vendor databases. She said, “I’ve become an expert in 28 GST slabs across locations, but barely have time analyzing smart spending decisions.”

The Hidden Costs Nobody Discusses

What really opened my eyes was seeing how fragmented and costly Accounts Payable actually is. We’re not just talking obvious stuff – delayed payments, compliance penalties, audit nightmares. There’s this shadow economy of inefficiency that most businesses don’t realize exists.

Invoice routing delays kill you. The Chennai vendor submits invoices, but the approval authority sits in Gurgaon. By the time documents travel through email chains, get lost in inboxes, and reach the right person, you’ve blown payment terms. Early payment discounts? Gone. Now you’re looking at late payment interest.

One manufacturing client calculated ₹18 lakhs in annual losses just in missed discounts across four facilities. Real money walking out because approval workflows couldn’t match business velocity.

How Modern Businesses Solve Multi-Entity Chaos

Three months ago, I watched something remarkable. A textile manufacturer with Tirupur, Ludhiana, and Surat operations implemented intelligent Accounts Payable automation. Within six weeks, their entire financial operations transformed.

Instead of chasing invoices across locations, their system automatically captured documents from every channel – email, WhatsApp, web uploads, even regional language scans. The AI understood cotton purchases in Tirupur needed a different GST treatment than Ludhiana yarn procurement, applying correct calculations without human intervention.

Their consolidation process blew my mind. Previously, teams spent the first week or month just collecting location data. After automation, their CFO pulled real-time liability reports across three facilities during our initial call.

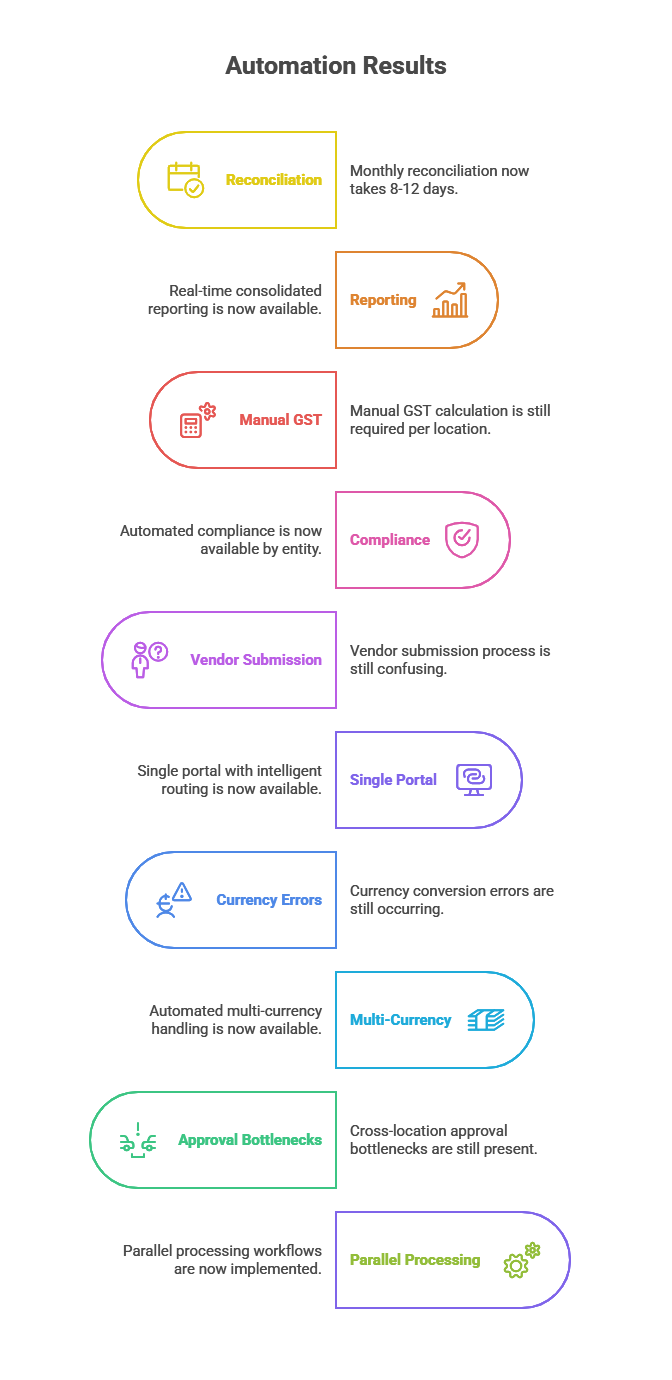

| Traditional Challenges | Automation Results |

|---|---|

| 8-12 days monthly reconciliation | Real-time consolidated reporting |

| Manual GST per location | Automated compliance by entity |

| Vendor submission confusion | Single portal, intelligent routing |

| Currency conversion errors | Automated multi-currency handling |

| Cross-location approval bottlenecks | Parallel processing workflows |

The finance head told me: “For the first time in five years, I spent last weekend with my family instead of fixing invoice discrepancies.”

Why Cookie-Cutter Solutions Fail

Most Accounts Payable vendors completely miss the mark. They build single-entity solutions and slap “multi-company” labels on basic permission features. I’ve evaluated systems claiming multi-entity support but can’t handle shared vendors serving multiple subsidiaries.

Last month, I consulted for a company using one “multi-entity” platform. They had Reliance registered separately in Mumbai, Pune, and Chennai databases. Same company, same GSTIN, but three vendor records. When Reliance submitted invoices, the system couldn’t determine which entity relationship to use.

Their accounts team manually routed vendor communications, maintained separate approval chains for identical transactions, and created custom reports because the system couldn’t aggregate data intelligently. They paid enterprise prices for glorified spreadsheet functionality.

The ValueDX Difference: Built for Indian Multi-Entity Reality

What excites me about ValueDX is their first-principles approach to multi-entity challenges. Instead of retrofitting single-company architecture, they designed their platform around modern Indian business realities – multiple locations, varying compliance, shared vendors, and needs for both granular control and consolidated visibility.

Their template-free processing handles Hindi, Tamil, English, or any vendor language, automatically routing to correct entities based on content analysis. Whether it’s ₹25,000 Kochi office supplies or ₹15 lakh Indore equipment purchases, the system applies appropriate GST rates, TDS calculations, and e-invoicing validations without manual configuration.

The multi-channel vendor portal solves communication chaos I see everywhere. Suppliers submit through web, email, or WhatsApp, with intelligent routing ensuring invoices reach right entity approval chains automatically. No more vendors calling accounts asking which email for different locations.

Their outcome-based pricing impressed me most. You’re not paying massive upfront fees testing whether multi-entity automation works for your situation. You see 80% processing workload reduction first, measure actual time savings, then invest based on demonstrated results.

Your Multi-Entity Future Starts Now

I’ve worked with enough finance leaders recognizing exhaustion in Priya’s voice from that traffic call. You’re managing brilliant businesses, serving demanding customers, competing in dynamic markets – but handicapped by Accounts Payable processes designed for simpler times.

Technology exists today, transforming scattered, manual invoice management into unified, intelligent systems,making multi-entity operations smoother than single-location processes used to be. With ValueDX‘s rapid deployment, your entire organization operates within days, maintaining existing workflows while gaining AI-powered capabilities.

Your team deserves tools matching their competence. Your business deserves financial operations enabling growth rather than constraining it. The question isn’t whether you can afford comprehensive multi-entity Accounts Payable automation – it’s whether you can afford another month of current frustration.

Send your sample invoice to info@ValueDX.com — we’ll get back to you with the extracted data.

Read our next blog – Click here