I still remember a call with a finance head in Mumbai who sounded exhausted. “We bought an OCR tool last year,” she said, “but my team is still correcting fields line by line. It’s like paying for a treadmill and still taking the stairs.” I laughed, because I’ve seen that movie. The invoices keep coming—in English, Marathi, Hindi, scanned, snapped on phones, even with handwritten totals. And despite the shiny “OCR” label, humans end up doing the heavy lifting. Here’s the thing: the real shift isn’t from manual to OCR. It’s from OCR to AI-led invoice data capture—the kind of intelligent extraction analysts like Forrester and others have been spotlighting as the next wave of document processing.

Why OCR hits a ceiling (especially in India)

OCR reads characters. That’s it. It doesn’t truly understand invoices. The minute formats change, the vendor switches templates, or the total is scribbled in pen, accuracy sinks. Throw in India-specific fields—GSTIN validation, HSN/SAC codes, TDS/TCS logic, e-invoice IRN checks—and typical OCR stacks become a patchwork of scripts. I’ve watched teams in Pune and Bangalore spend hours “teaching” templates for every vendor and then re-teaching when layouts shift. Meanwhile, business keeps moving, and the AP clock keeps ticking.

What AI-led extraction actually does differently

Modern AI goes beyond “reading” to “reasoning.” It detects document types, learns field relationships, and adapts to unseen layouts. It can interpret totals vs. taxes vs. discounts, infer vendor names from logos, and cross-verify GSTINs against expected formats. With Indian invoices, it can apply rule-plus-learning logic to split CGST/SGST/IGST, validate e-invoice numbers, and flag TDS applicability based on vendor category and section. Template-free extraction matters because your vendor list isn’t static—and neither are their formats.

I’ve been working with finance teams that get invoices via email, vendor portals, and yes, even WhatsApp. An AI system that normalizes all those inputs, auto-classifies the document, and safely extracts line-items (including handwritten annotations) without a template is a game-changer. What’s crazy is how quickly models improve with feedback loops: the system self-corrects, and the exception rate drops week by week.

The numbers don’t lie (₹ and hours saved)

Before AI, I often see per-invoice processing costs in the range of ₹35–₹60 when you add up AP associate time (₹25,000–₹40,000/month), supervision, and rework. With AI-led capture, clients routinely bring that down to ₹8–₹15 per invoice, while cutting cycle times from 3–5 days to same-day posting for clean cases. One client in Delhi processing ~30,000 invoices per month saw 80% workload reduction in the first quarter—freeing the team to chase vendor reconciliations and early payment discounts worth ₹12–₹18 lakhs per quarter. Another in Pune reduced GST mismatch penalties and late fee risks by ₹3–₹5 lakhs annually thanks to automated GST/TDS checks and e-invoice validations.

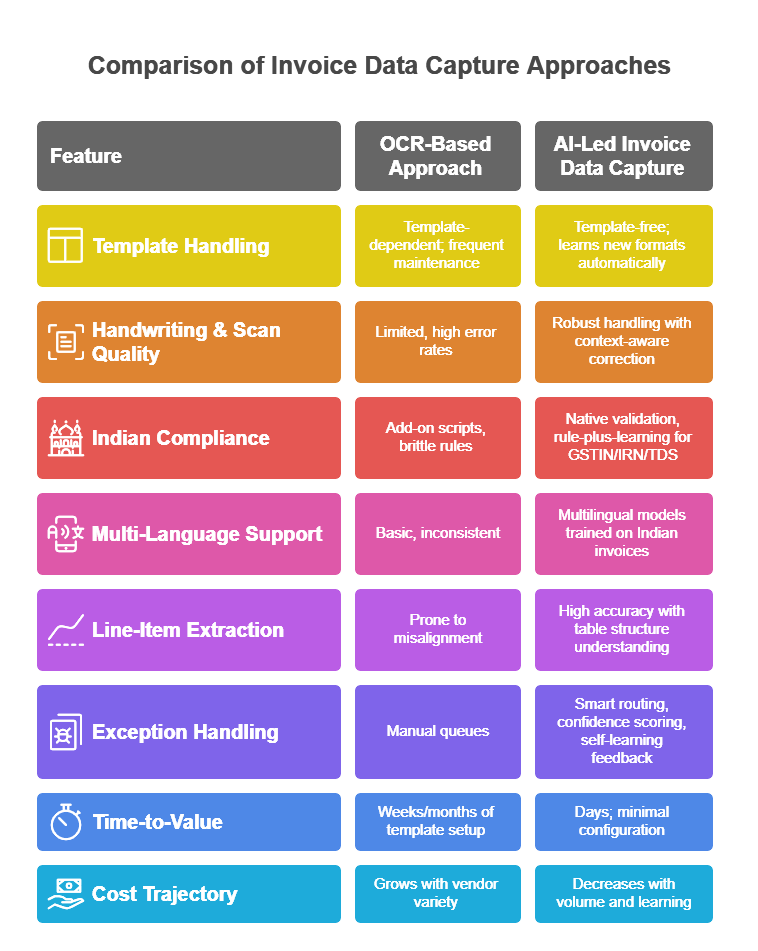

Traditional OCR vs. AI-led invoice data capture

| Capability | OCR-Based Approach | AI-Led Invoice Data Capture |

|---|---|---|

| Template handling | Template-dependent; frequent maintenance | Template-free; learns new formats automatically |

| Handwriting & low-quality scans | Limited, high error rates | Robust handling with context-aware correction |

| Indian compliance (GST/TDS/e-invoice) | Add-on scripts, brittle rules | Native validation, rule-plus-learning for GSTIN/IRN/TDS |

| Multi-language (English/Hindi/Marathi, etc.) | Basic, inconsistent | Multilingual models trained on Indian invoices |

| Line-item extraction | Prone to misalignment | High accuracy with table structure understanding |

| Exception handling | Manual queues | Smart routing, confidence scoring, self-learning feedback |

| Time-to-value | Weeks/months of template setup | Days; minimal configuration |

| Cost trajectory | Grows with vendor variety | Decreases with volume and learning |

How ValueDX makes this simple (and zero-risk)

At ValueDX, we built AI-driven, template-free extraction that plugs into your world—ERP, emails, vendor portal, even WhatsApp submissions. We pair that with Indian compliance automation out of the box: GSTIN validation, HSN/SAC checks, TDS rules, and e-invoice IRN verification. You get real-time cash-flow visibility, auto-reconciled liabilities, and dashboards that actually make sense to the CFO and the AP manager.

We position ourselves as your Accounts Payable automation partner, not just a software vendor. That means outcome-based pricing (no upfront fees) and rapid deployment measured in days, not months. Frankly, I’m naturally skeptical of tech buzzwords, but what really impressed me was watching exception rates fall below 10% by Month 1 at a Bangalore client without writing a single template. The team told me, “For the first time, we’re closing faster without staying late.”

What implementation looks like (no disruption)

- Week 1: Connect inboxes/portals, baseline your data, switch on extraction; quick validations for GST/TDS/e-invoice; light ERP integration (no downtime).

- Month 1: Exception rate drops 40–60%; straight-through processing expands; ₹ savings begin to show in approval cycle time and posting accuracy.

- Month 3: 80% processing workload reduction is typical; clean audit trails, fewer GST mismatches, and predictable DPO improvements; teams redeploy time to vendor relations and cash optimization.

A quick reality check

Will there still be exceptions? Of course. But with AI-led extraction, you’re not fighting fires every day. You’re configuring policies once and letting the system do the grunt work. And when formats change—or a vendor in Ahmedabad sends a new bilingual template—you won’t scramble to build templates. The model adapts. That’s the leap beyond OCR that analysts like Forrester have been highlighting: intelligent document processing that learns, validates, and keeps pace with the business.

If you’re tired of paying for a treadmill and taking the stairs, let’s get you on an escalator.