The week started in Mumbai, somewhere between Lower Parel traffic and the smell of vada pav frying at the street corner.

By the time I got to the client’s 10th-floor office, my shirt collar had surrendered to the humidity.

The CFO was behind a desk that looked less like furniture and more like a paper recycling station.

Invoices everywhere — some neatly bound with green thread, others stuffed into clear plastic folders that had clearly been reused a dozen times.

He pushed one pile toward me and said, “If you think all this vanishes in a week, boss, you’re dreaming.”

And I laughed — because just last quarter I watched a Pune manufacturer try exactly that.

Four days into “full automation,” their finance team was in open revolt.

One poor guy was manually checking GST numbers on a laptop that kept disconnecting from the Wi-Fi every 20 minutes.

Two days later, I was at a plant in Bhosari MIDC.

We’re doing what I call “following the paper trail.”

It starts with Ramesh at the security gate, who takes the delivery note and sticks it into a cardboard folder labelled with last year’s date.

From there, it goes to an Accounts Payable clerk who sits next to a dot-matrix printer that hasn’t stopped squealing since 2009.

Here’s the twist — they thought their biggest bottleneck was slow manager approvals.

It wasn’t.

It was a Nagpur vendor who sent every invoice handwritten in blue Reynolds ink, folded into four, with tea stains in one corner.

I asked the AP clerk why they hadn’t told the vendor to send typed bills.

She shrugged and said, “He’s been doing it like this since my first job here. It’s… tradition.”

We ran one of those tea-stained bills through ValueDX’s AI.

It read perfectly. No templates. No human retyping.

The room went silent, then someone muttered, “Arre, ab toh hum chutti le sakte hain” (“Now we can take a holiday”).

The pilot phase was next.

We picked 15 vendors — the ones whose names the AP team could rattle off like a cricket batting order.

Some sent crisp PDFs by email.

Some uploaded to the vendor portal.

And yes, a couple sent WhatsApp pictures at 11:37 p.m., complete with their kitchen countertop in the background.

Before automation: About 6 minutes per invoice, ₹18 in cost.

After automation: 1.1 minutes, ₹4.25.

The Accounts Payable manager — a no-nonsense woman named Shalini — kept refreshing the dashboard like it was the IPL scoreboard.

At one point she called me over, pointing at the screen. “Is this… real time?”

It was.

By month two, we started scaling.

This is where the fun (and chaos) happens.

We brought in smaller vendors — the stationery supplier from Dadar who sends bills on pink carbon paper, the packaging guy from Thane whose invoices come stapled to a sample carton, and my personal favourite: a courier company from Navi Mumbai that sends scanned PDFs so faint you’d think they were drawn with a pencil.

We flipped on every channel: email intake, portal submissions, WhatsApp integration.

ValueDX handled all of it — GST/TDS validation in seconds, handwriting recognition even in half-faded ink, multi-language support when someone decided to write “Paid” in Marathi.

One Delhi CFO — the kind who answers emails at 6:15 a.m. — sent me a message that simply read:

“For the first time, I can see every pending liability before my morning chai. This is dangerous… I might get used to it.”

Here’s what changed, in real numbers:

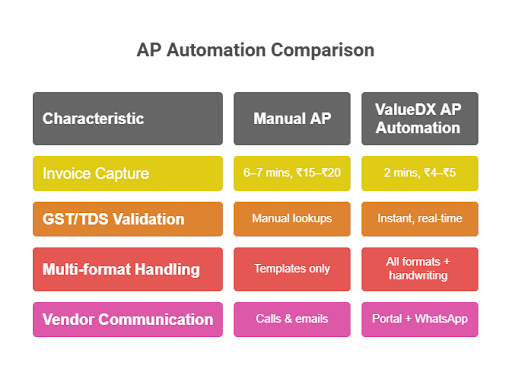

| Step | Manual AP | ValueDX AP Automation |

|---|---|---|

| Invoice Capture | 6–7 mins, ₹15–₹20 | < 2 mins, ₹4–₹5 |

| GST/TDS Validation | Manual lookups | Instant, real-time |

| Multi-format Handling | Templates only | All formats + handwriting |

| Vendor Communication | Calls & emails | Portal + WhatsApp |

By month three, the game shifted from “speed” to “insight.”

Real-time dashboards showed exact payable amounts — ₹34.7 lakh here, ₹5.2 lakh there — all tagged by vendor and due date.

Cash flow projections stopped being educated guesses and started sounding like certainties.

One Bangalore client laughed when I pointed this out.

“Last year,” he said, “I got a GST mismatch notice in March for an invoice from July. Now? I get a system alert before the vendor has even left my building.”

Why phased works here is simple:

- Compliance never sleeps — GST/TDS rules shift like the Mumbai skyline.

- Vendors are unpredictable — from Lower Parel corporates to small-town traders with basic phones.

- Teams need proof — trust builds only when they see it working.

ValueDX makes this painless — no upfront payments, no ERP downtime, no “we’ll see after six months” gamble.

We’ve deployed in three days flat for clients without interrupting a single payment cycle.

One Delhi textile exporter put it perfectly:

“Earlier, my Fridays were for chasing invoices. Now they’re for catching a movie.”

And that’s the whole point — freeing up your team from the grind so they can think about the business, not just push paper around.

Because Accounts Payable automation in India isn’t a button you press.

It’s a journey.

And the best journeys?

You take them one phase at a time.

Read our next blog – Click here