The money leaks no one talks about!

The Silent Profit Killers

That nagging feeling that something’s wrong with your finances? You’re probably right. After fifteen years in finance, I’ve seen mid-sized companies lose ₹40 lakh – ₹2.5 crore annually through tiny inefficiencies that never make it onto anyone’s radar.

These aren’t dramatic system failures—they’re mundane friction points everyone accepts as “normal business.” Your Accounts Payable clerk creates Excel workarounds. Managers build personal tracking systems. These feel helpful but actually signal expensive underlying problems.

Why Problems Stay Hidden

Most finance leaders live in the dashboard bubble, seeing high-level metrics that show what happened but never why it took so long. I once worked with a CFO who was proud of his eight-day invoice processing time. What didn’t he realize? Sixty percent of invoices sat in email inboxes for five days, not due to workload, but confusion about routing.

Department silos compound the problem. Procurement optimizes vendor onboarding speed while AP drowns in improperly formatted invoices from those same “efficiently” onboarded vendors. Each department looks good individually, while the overall process suffers.

Workaround addiction creates fragile systems held together by individual heroics. Sarah’s tracking spreadsheet helps her, but what happens when she leaves? These “solutions” mask systemic issues while creating new dependencies.

The Real Money Drains

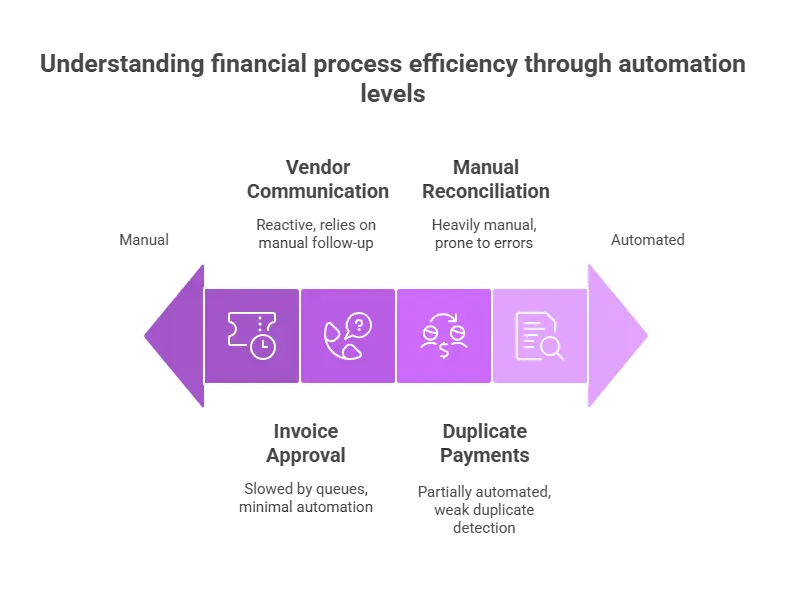

Invoice approval purgatory: That “two-day” process actually takes two weeks because invoices spend 90% of their time waiting in queues, not being actively processed.

Duplicate payments: Industry estimates suggest 2-4% of payments contain duplication, but I’ve seen closer to 7%. Different submission channels, manual data entry variations, and weak duplicate detection create expensive oversights.

Manual reconciliation hell: When monthly close means archaeological digs through transaction layers, you’re not doing accounting—you’re doing damage control from your Mumbai or Bangaluru office.

Vendor communication chaos: Every “Where’s my payment?” call represents interrupted productivity and relationship strain.

How to Find These Issues

Walk your actual process—forget documentation and physically follow invoices through your system. Time everything. You’ll discover undocumented steps and invisible bottlenecks.

Analyze exception patterns: Forty percent of invoices from your biggest vendor requiring manual correction isn’t an Accounts Payable competency issue—it’s a systemic process problem.

Talk to frontline employees: They know exactly where problems are because they create workarounds daily. Ask specific questions: “What feels like unnecessary work?” “What information do you need but can’t get?”

A Real Example

One of our leading companies of India, a ₹120 crore electronics supplier based in Pune, thought their seven-day average processing looked reasonable until we discovered a huge chunk of invoices were processed twice due to communication gaps. Vendors submitted electronically but also emailed procurement, who forwarded to AP for manual entry. Small data entry variations defeated duplicate detection.

Your Next Steps

Start immediately with a simple audit. Pick five recent invoices and trace their complete journey, timing each step. Focus on quick wins: simplifying approvals, standardizing data entry, improving vendor communication.

Remember: optimize processes before automating them. The most successful companies treat efficiency as a strategic advantage, understanding that small workflow improvements compound into major competitive benefits.

Transform Your AP with ValueDX

While identifying inefficiencies is crucial, real transformation requires the right expertise. ValueDX’s AI-powered accounts payable automation solution intelligently optimizes workflows based on your specific patterns.

Our comprehensive approach delivers:

- Automated efficiency discovery reveals hidden bottlenecks

- Intelligent process optimization that continuously improves

- Seamless ERP integration without costly replacements

- Measurable results: 60-80% processing time reduction, 90% straight-through processing improvement, huge annual savings for Indian enterprises

Contact ValueDX today (info@valuedx.com) for a complimentary workflow assessment and discover your organization’s savings potential.

Take action this week: map one complete invoice workflow, time each step, and identify bottlenecks. The discoveries might surprise you.

Send your sample invoice to info@valuedx.com — we’ll get back to you with the extracted data.

Send your sample invoice to info@valuedx.com — we’ll get back to you with the extracted data.

Read our next blog – Click here