I still remember the sinking feeling in my stomach when a client called me, voice shaking: “We just discovered we’ve been paying the same vendor twice for the past eight months. Same invoices, slightly different formatting. We’re out nearly $200,000.”

What made it worse? Their manual review process had multiple people checking invoices, but somehow this slipped through every single time. That’s when I realized something scary – human eyes are really bad at catching the subtle tricks fraudsters use.

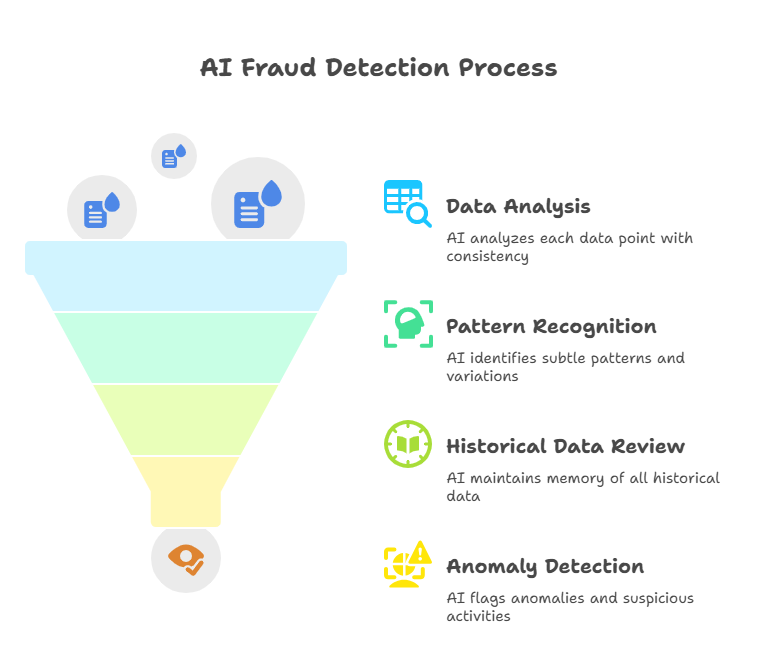

But AI? AI never gets tired, never overlooks details, and never assumes something is legitimate just because it looks familiar.

The Fraud Reality That Keeps CFOs Awake

Let’s talk about what’s really happening out there. AP fraud isn’t some distant threat you read about in industry reports – it’s happening to companies every single day. Duplicate invoices with tiny variations, fake vendor schemes, inflated amounts on legitimate invoices, and sophisticated email spoofing attacks.

I’ve watched companies lose hundreds of thousands of dollars to fraud that seemed obvious in hindsight but was practically invisible during day-to-day processing. The worst part? Most of these companies had good people, solid processes, and multiple approval layers. But fraudsters have gotten really, really smart about exploiting human psychology and manual process gaps.

Why Manual Fraud Detection Fails

Here’s what I’ve learned from watching fraud investigations: humans are terrible fraud detectors when processing high volumes. We get into routines, start recognizing patterns, and begin operating on autopilot.

A fraudster submits an invoice that’s 99% identical to a legitimate one they paid last month, just with a slightly different invoice number and date. Your AP person glances at it, recognizes the vendor name, sees the familiar format, and processes it without a second thought.

Or they create a vendor that’s almost identical to a real one – “Microsoft Inc.” instead of “Microsoft Corporation” – with banking details that route to their account. Human reviewers see “Microsoft” and assume it’s legitimate.

These aren’t failures of intelligence or diligence. They’re failures of human psychology when dealing with repetitive tasks.

How AI Sees What We Miss

AI approaches fraud detection completely differently. Instead of getting tired or falling into patterns, it analyzes every single data point on every single invoice with the same intensity.

Here’s what modern AI fraud detection catches that humans miss:

| Human Review | AI Analysis |

|---|---|

| Recognizes familiar vendor names | Cross-references exact vendor details |

| Checks obvious duplicates | Identifies subtle variations and patterns |

| Reviews invoices individually | Analyzes relationships across thousands |

| Focuses on recent transactions | Maintains memory of all historical data |

| Gets fatigued with high volumes | Maintains consistency at any scale |

I watched one AI system catch a vendor who was submitting invoices with amounts that gradually increased by small percentages over months. No human would have noticed the pattern, but the AI flagged it immediately.

The Sophisticated Fraud Patterns AI Catches

What really impressed me was seeing AI detect fraud schemes I never would have thought to look for. Invoice amounts that fell just below approval thresholds, vendor banking details that changed subtly over time, submission patterns that suggested coordinated attacks, and document formatting that indicated manipulation.

One client’s AI system caught a scheme where someone was creating fake invoices for services that were never ordered, but the amounts and timing were designed to blend in with legitimate recurring expenses. The AI spotted the pattern in vendor behavior and flagged it for review.

Speed Without Compromise

Here’s the beautiful thing about AI fraud detection – it happens in real-time without slowing down your AP process. Every invoice gets scrutinized for fraud indicators as part of the normal processing workflow. Legitimate invoices flow through instantly while suspicious ones get flagged for human review.

No delays, no bottlenecks, no trade-offs between security and efficiency.

The Prevention vs. Detection Game

Traditional approaches focus on detecting fraud after it happens. AI-powered systems prevent fraud before payment goes out. They catch duplicate invoices before the check is cut, identify suspicious vendors before you add them to your system, and flag unusual patterns before they become costly schemes.

I’ve seen companies recover hundreds of thousands in prevented losses within months of implementing AI fraud detection.

Real-World Impact

The numbers tell the story. Companies using AI fraud detection typically see 95% reduction in duplicate payments, 90% fewer fraudulent vendor schemes, 80% faster fraud detection when it does occur, and virtually zero false positives disrupting legitimate payments.

But the real value? Peace of mind. Finance teams sleep better knowing that AI is watching for threats 24/7.

How ValueDx Builds Fraud Protection In

What sets ValueDX apart is that fraud detection isn’t an add-on feature – it’s built into the core of their AI-powered AP system. Every invoice gets automatically analyzed for fraud indicators as part of the normal processing workflow.

Their AI cross-references every invoice against historical data, vendor patterns, and suspicious indicators without any performance impact. Legitimate invoices process instantly while potential fraud gets flagged with detailed explanations for human review.

The system learns your specific vendor patterns and payment behaviors, becoming more effective at spotting anomalies over time. It handles everything from obvious duplicate detection to sophisticated scheme identification.

They use the same zero-risk approach – you only pay for successful processing. No upfront costs for fraud protection, no separate security systems to manage. Fraud prevention is just part of how their AP automation works.

I’ve watched companies eliminate fraud losses entirely within weeks of implementation while actually speeding up their AP processes.

Don’t Wait for the Next Attack

AP fraud is getting more sophisticated every year. The companies that get ahead of this threat are the ones that recognize human limitations and leverage AI capabilities for protection.

Your current fraud detection probably isn’t as good as you think it is. Why not find out what AI-powered fraud prevention could catch that you’re missing?

Read our next blog – Click here