You know what’s funny? I was having coffee with a CFO last week, and she told me something that made me laugh. “Our AP team? They’re like the office ninjas – we need them, but we pretend they don’t exist.”

That conversation got me thinking about how backwards this whole industry has become. We’ve turned one of the most strategically important departments into some kind of back-office afterthought.

Why We’ve Got This All Wrong

I can’t tell you how many companies I’ve walked into where the AP department feels like a punishment assignment. Stack of invoices on the desk, people hunched over keyboards all day, everyone counting down until five o’clock.

The crazy part? These same companies are hemorrhaging money because they’re missing obvious opportunities sitting right in front of them. It’s like having a Ferrari and using it to deliver newspapers.

When your AP team is just focused on “process faster, spend less,” you’re basically telling them to ignore everything strategic happening around them.

What I’ve Learned from Companies Getting It Right

Over the past few years, I’ve worked with some businesses that completely flipped this script. They stopped seeing AP as an annoying cost and started recognizing it for what it really is – a strategic nerve center.

Think about what’s actually flowing through your AP department every day. Purchase decisions, vendor relationships, cash flow patterns, and compliance requirements. It’s basically a real-time snapshot of your entire business operations.

One client put it perfectly: “Our AP team doesn’t just pay bills – they manage the financial heartbeat of our company.”

The Cash Flow Game-Changer

Here’s where things get really interesting. Most businesses treat bill paying like some kind of automatic reflex. Invoice comes in, check goes out. Rinse and repeat.

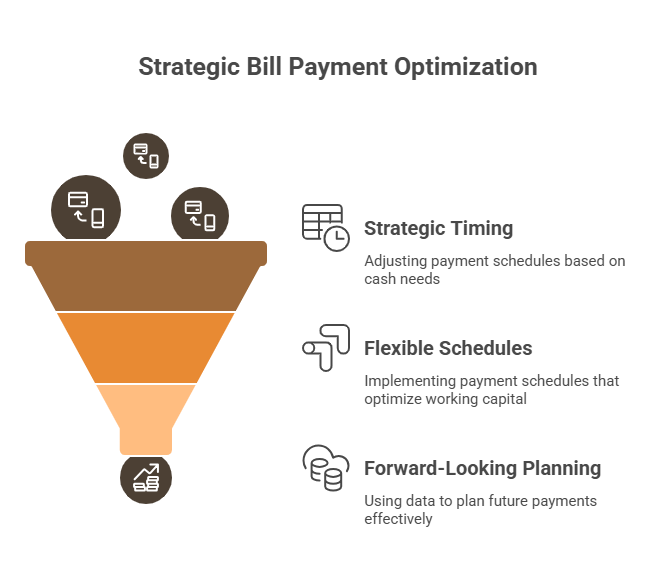

But the smart companies have figured out that payment timing is actually a strategic weapon. Instead of paying bills immediately with zero flexibility, they’re using strategic timing based on actual cash needs, flexible schedules that optimize working capital, and forward-looking planning with real data.

I watched one company improve their working capital by nearly 20% just by getting smarter about when they paid their bills. That’s real money flowing back into the business.

Vendor Relationships: The Secret Weapon

Here’s something that blew my mind when I first realized it. How you handle vendor payments completely changes how vendors treat you. I’ve seen companies get preferential treatment during supply chain crunches simply because they had a reputation for paying quickly and accurately.

When the chips are down and everyone’s fighting for inventory, guess who gets taken care of first? The company that vendors actually enjoy working with.

The Results Speak for Themselves

The companies that’ve made this transition are seeing incredible outcomes. We’re talking about 20-30% reductions in processing costs, working capital improvements that hit the bottom line directly, virtually zero duplicate payments, month-end closing times cut in half, and credit ratings that improve from consistent payment patterns.

But honestly? The biggest win is watching AP professionals go from feeling like glorified data entry clerks to becoming genuine business strategists.

Your Hidden Intelligence Network

Every invoice tells a story. Which vendors are reliable? Where are costs heading? What do spending patterns reveal about operational efficiency?

Most companies treat this information like it’s worthless, but the businesses that pay attention to these patterns are spotting problems months before they become crises and identifying opportunities their competitors completely miss.

Making It Real Without the Usual Hassles

I know what you’re probably thinking – this sounds great, but how do you actually pull it off without turning your department upside down?

The truth is, you can’t do this with manual processes. You need technology that handles the routine stuff automatically so your people can focus on strategy.

That’s where ValueDX has really impressed me. I’ve watched them transform AP departments without any of the usual implementation nightmares. Their AI handles all the mundane processing tasks while plugging into whatever ERP you’re already using.

What I really appreciate is their no-risk structure. You only pay for actual results. No massive upfront investments, no six-month implementation projects, no retraining your entire team.

I’ve seen companies start seeing results in the first week. By month three, their AP teams are participating in strategic planning meetings. It’s actually pretty remarkable how fast the transformation happens.

Stop Settling for Less

Every day you treat AP like it’s just a necessary expense, you’re leaving money on the table. Better vendor relationships, optimized cash flow, strategic insights that could change how you compete – it’s all sitting there waiting.

Your AP department is probably sitting on more untapped potential than any other part of your finance organization. Maybe it’s time to find out what they’re really capable of?

Read our next blog – Click here

Author: Gajanan Kulkarni