Transform Your Daily Cash Management — See Everything, Decide Faster

Get a clear view of your cash flow every morning with connected bank accounts, smart alerts, and actionable insights for confident decisions.

When Cash Visibility is Limited, Every Decision Becomes a Gamble

Key Pain Points:

Cash blind spots create unnecessary stress and lead to costly mistakes like overdraft fees or emergency borrowing

Waiting for manual updates and reconciling spreadsheets wastes valuable time when quick decisions matter most

Without forward-looking insights, teams react to problems instead of preventing them

Juggling multiple systems and data sources increases errors and makes it harder to see the complete picture

How We Solve Your Daily Cash Management Challenges

Complete Data Integration

Morning Cash Snapshot

Forward-Looking Projections

Smart Notifications & Guidance

Global Business Support

Streamlined Reconciliation

Workflow Automation

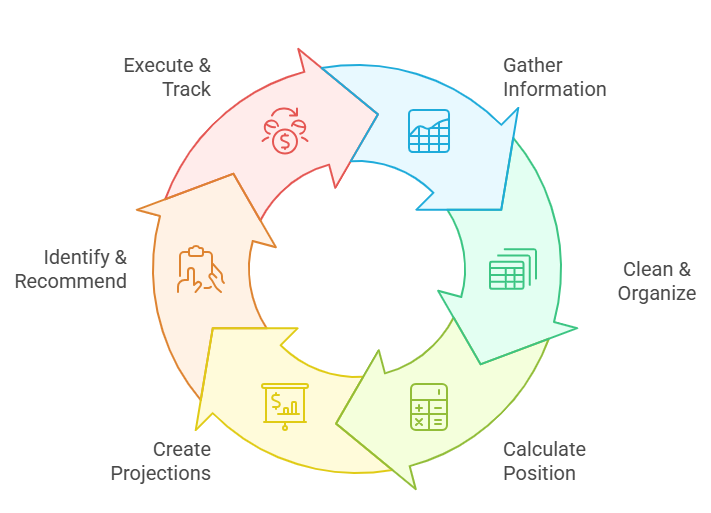

How the Process Works

Collect data from bank feeds, upcoming payments, outstanding invoices, and accounting systems

Standardize formats, map account relationships, and apply currency conversion rules

Determine today’s starting balance, expected inflows and outflows, and projected end-of-day position

Generate reliable forecasts using proven methods combined with machine learning insights

Spot unusual patterns, flag potential issues, and suggest specific actions with approval workflows

Process approved transfers and payments while automatically updating your records

Your Daily Command Center — Essential Metrics in One Place

Weekly & Monthly Cash Flow Projections

Expected Cash Movement (next 24 hours)

Total Available Funding & Credit Facilities

Operating Runway (based on typical spending patterns)

Priority Items Requiring Attention

Security & Technical Integration

Security Framework : Protects financial data with advanced encryption, controlled user access, and full activity tracking for audits and compliance.

Regulatory Compliance : Adheres to local financial regulations with secure credential management and robust data protection protocols.

System Connections : Integrates seamlessly with SAP, Oracle, and Microsoft Dynamics, supporting standard banking formats and payment interfaces.

Deployment Flexibility : Available as a cloud or on-premises solution, with options for specific data residency and dedicated network access.

FAQs

Daily cash balance monitoring is tracking the amount of cash your business has at the end of each day, factoring in inflows and outflows. It helps prevent surprises in liquidity, supports timely payments, and gives you proactive control over working capital.

ValueDX automates the capture of bank, invoice and payment data to deliver real-time visibility into your daily cash position, helping you identify trends and act before small issues become big ones.

First, determine your starting cash (previous day’s closing), add predicted daily inflows, subtract forecasted outflows, and reconcile actuals. Then compare predicted vs actual to adjust the next day’s outlook.

It can reveal delays in receivables, excessive outflows, missed discounts or late payments, and cash shortages before they escalate—allowing you to act proactively.

Use a short daily update (under 30 minutes), link to your bank and transaction system, highlight “opening balance + deposits – disbursements = closing balance,” and review weekly in context.

Experience the Difference Daily Cash Clarity Makes

See how your morning cash briefing could look in a quick 30-minute personalized demonstration.